Loan To Value calculator is a tool that is used to calculate the LTV ratio for a loan on a particular asset. Loan to Value is an important matrix for the lender to check the viability of a loan.

If you are to default on a loan having a high loan to value ratio, the lender will probably lose money.

The loan is something that has been around since the dawn of humanity and people of classes and lifestyles use loans, even powerful countries have to loan money from other countries.

Loan To Value is not only used by lenders but a borrower can also estimate the chances for their loan being approved by calculating Loan To Value.

You can find a bunch of Loan To Value Calculators online and most of them are pretty good and will carry out the calculations pretty seamlessly, but this article is about the best Loan To Value Calculators out there.

You don’t want to spend your time looking for the right calculator instead of using it.

Stick with this article as it reviews the best calculators on the internet so you can get the one that is the best Loan To Value Calculator for yourself.

Hopefully, after reading this article and using the calculators mentioned, you will be able to calculate an accurate Loan To Value and determine the viability of your loan.

Best Loan To Value Calculator

1. Bankrate: Loan to Value Calculator

Bankrate is a popular finance and investment website, you will find various tools and content related to topics like mortgages, loans, investing, insurance, etc.

You can create an account on the website and get full access to the website, although most of the functions of the website are still accessible without an account.

Bankrate’s Loan to Value Calculator is a really capable tool just like all the other tools and calculators on this website.

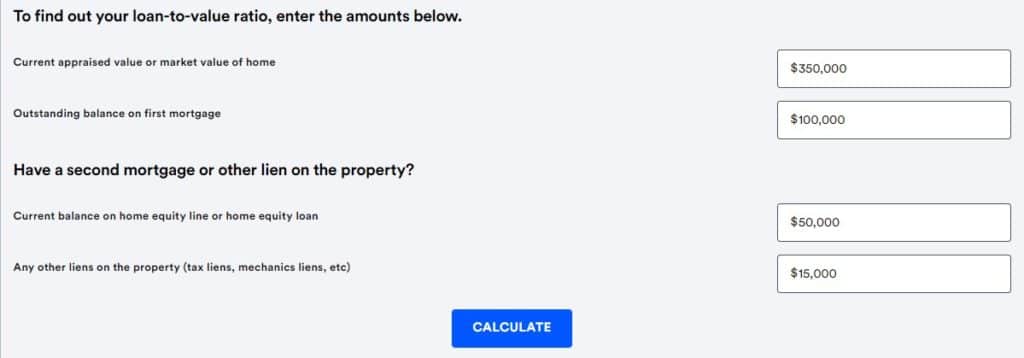

The UI of the calculators on this list is more or less the same, the difference that you’ll notice would mostly be in their designs. You have a total of 4 inputs that you need to enter into this calculator.

First enter the value of the asset and the outstanding balance on the first mortgage, if you have a second mortgage enter its details in the second section of the calculator.

If we talk about the design of the website of Bankrate, it mostly consists of simple elements and details but ends up giving a really great look.

There are almost no colors used on the website except for black, white, and grey, which you would think will seem boring but actually turn out to be quite professional.

The design stays pretty uniform throughout the website and you certainly won’t face any problems in terms of the design.

Once you have entered the details for your loan, click ‘CALCULATE’, and your first mortgage loan to value percentage and the cumulative loan to value (if you entered a second mortgage). If you scroll down you can view the current mortgage rates by entering your zip code.

2. Money Facts: Loan to Value (LTV) calculator

Money Facts, just like Bankrate is also another business and finance website homing guides and tools for all kinds of financial topics.

The motto of Money Facts is “The money comparison experts” and that is exactly what you’re doing when calculating Loan to Value.

Money facts also have a news section that you can check out to see the current rates for different types of loans.

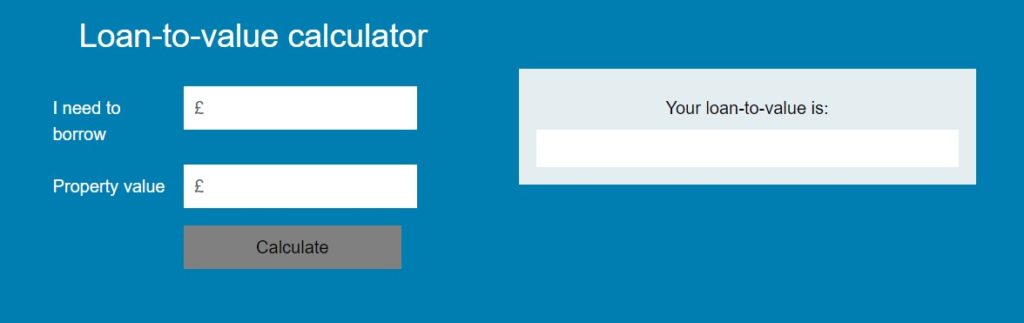

UI of Money Facts’ Loan to Value Calculator is pretty simple, a lot simpler than the Bankrate that we discussed above. You only need to enter two inputs; ‘I need to borrow which will be your loan and the ‘property value’.

There are no extra details like a second mortgage on this calculator, and the font and style that has been used on the calculator really makes it inviting for the users.

From a design point of view, it is hard to find a flaw in Money Facts’ website. All the sections and buttons are conveniently located on the home page without any hidden details.

The soft blue color scheme helps the website seem not too overwhelming and there are only a few ads on the website, which conveniently are related to mortgages.

Their place is such that they won’t disrupt your operations with the calculator.

Once you have entered the loan amount and the property value, click ‘Calculate’, your loan to value will be shown on the right side of the calculator.

Just like the inputs, the outputs of Money Facts’ Loan to Value Calculator are also simple. If you scroll down you can see a few links regarding the mortgage rates if you wanna check those out.

3. Fannie Mae, Know Your Options: Loan to Value (LTV) Ratio Calculator

Fannie Mae is a website that mostly focuses on houses and mortgages, it doesn’t matter if you have to sell, buy or rent, Fannie Mae has got you covered.

You can find a few tools related to mortgages on this website including a Loan to Value calculator. Fannie Mae is definitely the right option for you if you are calculating Loan to Value for a house loan.

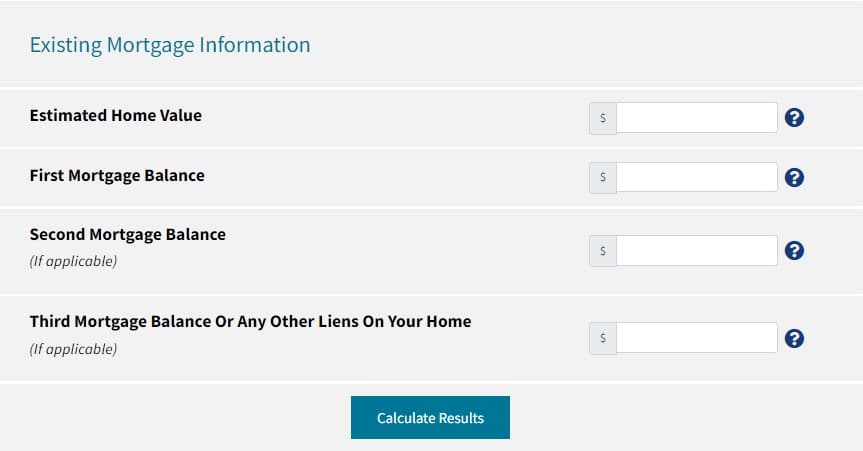

If we talk about the design of the calculator, it is both unique and similar when compared to the rest of the calculators on this list.

You have different sections for inputs and results, which is unique to this calculator but the type of inputs and results are almost the same.

Enter the value of the asset and balance of your mortgage to find Loan to Value, you also enter the details for a second mortgage if it applies to you.

The design of the website is quite organized and gives you a professional vibe.

All the contents and tools of the website can be easily accessed from the home page which translates to a really good user experience. Even the dark blue colors used all over the website give a really corporate vibe, making the website look more credible.

Once you input all the entries in the ‘Inputs’ section, click ‘Calculate results’ and you will be directed toward the results section in under a second.

There you will find all the inputs you entered and their corresponding Loan to Value. There are no ads on the website to distract you which is always a good thing. Fannie is a great option for you if need a well structured calculator.

How is Loan to Value Calculated

Now that you have gone through some of the best calculators that the internet has to offer it is also a good idea to have a little bit of concept of calculating Loan to Value, although these calculators will do most of the work for you.

Calculating Loan to Value is basic maths, you only need to perform one arithmetic functioning to determine your Loan to Value, for example:

You need a loan of $200000 for a house, and the market value of the house is $250000.

Loan to Value = Loan Amount/ Value of the Asset

= 200000/$250000

= 0.8

Multiply it by 100 if you want the percentage.

End Note

The importance of structured loans has increased exponentially with the modernization of the society. Mortgages are more popular than ever in middle class and upper middle class families and couples.

Loan of Value is a very important term that all the lenders and borrowers should be aware of and should also know how to use it.

All the Loan to Value calculators discussed above are pretty great and will give you accurate Loan to Value, which you can use to determine the viability of your loan or mortgage.

Try out all the calculators that have been mentioned in this article so you can find the one that suits you the best depending on your requirements.