Snowball debt calculator is an online tool that assists you to estimate how long it will take you to pay off your debts.

It helps you construct a payoff plan that you can follow and pay off all your debts in a calculated time frame. Stick to this article to find yourself the best snowball debt calculator.

Snowball is a method that you follow to pay off the smallest of your debts as quickly as possible. Once you pay the debt, you then take that money being used for that payment and roll it into the next owned debt.

This process continues until all the debts are paid off.

Snowball method is considered the fastest way to pay off debts. There are several other debt-paying methods but snowball is the quickest. The sooner you pay off your debts, the better.

You become stress-free and peacefully carry on with your other chores.

Snowball debt calculators as the name indicate; operate on the snowball method and allow you to follow a calculated plan in a calculated time frame to pay off your debts.

You have to strictly follow the plan to become free of debts as fast as possible.

Snowball debt calculator is constructed on the advanced formula. You have to insert the debt, then enter your account balance and the minimum payment that you can pay with ease.

Snowball debt calculator will formulate a plan along with the estimated time and amount you have to pay every month.

If you follow the stepwise debt paying-off plan created by the snowball debt calculator, you can not only become debt free, but you can also save money for the future.

You just have to tag along the plan that snowball debt calculator will generate for you.

Snowball debt calculators have made a huge difference in the lives of today’s people. Now you do not have to sit for long hours and stress over manually calculating the debt or manually formulating a plan.

Manual calculations are time-consuming and they have a high chance of error. But worry no more as the snowball debt calculators got you covered.

Surprisingly there is a wide variety of snowball debt calculators available online and in the market with innumerable interfaces.

Best Snowball Debt Calculator

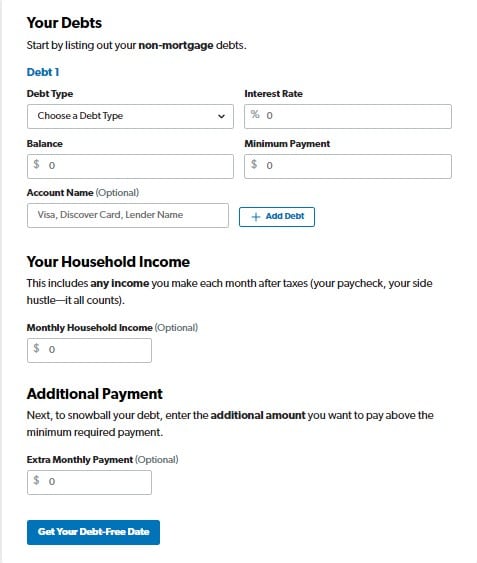

1. Ramsey Solutions Debt Calculator: Solutions Debt Calculator

Ramsey solution snowball debt calculator is a free online tool that helps you calculate a debt-free date (the day you will pay off all your debts). It has general definitions that explain the basic terms.

It has a stepwise guideline mentioned below the calculator.

You will find the comparison between snowball debt calculators with other types of debt calculators. It has all the pros and cons of all the calculators and it makes it easy for you to select the right calculator for you.

The interface is clear with no unnecessary advertisements and cookies; you can peacefully carry out your calculations without any interference.

Ramsey solution snowball debt calculator offers you related articles that you can read to enhance your knowledge and understanding.

For calculation, you have to select your debt type, interest rate, balance and the minimum payment you can afford. Then press on ‘get your debt free date’ and you will receive the estimated date.

You can optionally add monthly household payments and monthly extra income for accurate results.

You can even add more than one debt. The more particulars you will add, the more accurate results you will receive.

You can select the type of date you prefer and Ramsey solution snowball debt calculator will provide you with the final date according to your requirement.

You can create an account on the Ramsey solution snowball debt calculator by signing up through your email address. You can take a survey of the calculator by becoming a member.

The survey introduces you to the system and operations of the calculator.

Survey helps you understand how to use the calculator and carry out calculations. Ramsey solution snowball debt calculator has an online store from where you can order different products at discounted rates.

It is like an online mart that comes in handy with free shipping charges.

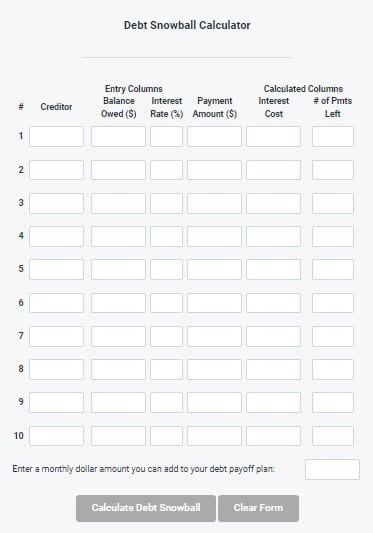

2. Financial Mentor Snowball Debt Calculator: Snowball Debt Calculator

Financial mentor snowball debt calculator is a detailed online tool that is absolutely free.

You can find out the correct dates and debt amount that you have to pay through this calculator. It uses the ‘rollover’ method that helps you pay off debts quickly.

The interface is mostly clear with a few advertisements, but they do not come in between your calculations and you can work calmly. Financial mentor snowball debt calculator claims to be the fastest debts payoff, calculator.

For calculations, you have to fill the rows and columns with your details so the financial mentor snowball debt calculator can provide you with accurate results.

You have to enter the creditors, balance owned ($), interest rate (%), payment amount ($), interest cost and the number of payments left.

Then click on ‘calculate debt snowball’ and the whole report will appear in front of you. The results appear in detail so you can easily interpret the results.

The results you will receive are current totals, debt snowball totals and time and interest savings from an accelerated debt payoff plan. The detailed results allow you to better comprehend the results and follow the plan of action accordingly.

Financial mentor snowball debt calculator gives you the option to obtain the results in the form of a summary. You have to click ‘create payoff summary’ and the summary will display in front of you.

Financial mentor snowball debt calculator has a complete guidelines in steps so you can understand how to follow the plan and get rid of your debts as fast as you can.

You will find relevant article links in between the guidelines that you can read to enhance your knowledge.

There are some motivational paragraphs at the end that motivate you to stay out of debt and save for the future. Everything is explained with terms and their definitions so you do not face any difficulty understanding the concept.

You can become a member of financial mentor snowball debt calculator by signing up via your email address.

If you are weak in calculating the debt or understanding the procedure, you can take online coaching classes from financial mentor snowball debt calculator experts.

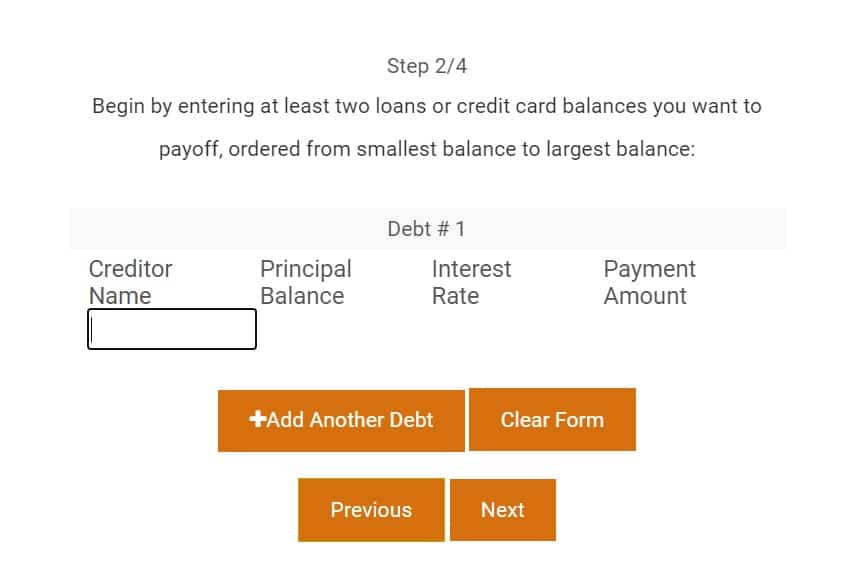

3. Crown Snowball Debt Calculator: Snowball Debt Calculator

Crown snowball debt calculator is a free convenient online tool that assists you to pay off your debts as quickly as possible.

You can credit your smallest to largest sum here and it will provide you with a complete solution to pay off your debt.

The interface is not so clear but it is also not distracting as all the advertisements appear on the side of the calculator.

One important aspect of crown snowball debt calculator is that you cannot use this calculator without signing up for it.

For calculation, you have to answer the questions like a quiz by filling in your details.

The calculator will ask you questions and after answering every question the next one will appear. You have to enter the principal balance, interest rate and payment amount.

Then you have to enter your monthly pay, press on ‘calculate’ and the final summary or plan will appear in front of you.

You can turn on the weekly subscription by becoming a member and crown snowball debt calculator will divide the monthly payoff into the weekly payoff.

Crown snowball debt calculator has online debt payoff lectures that you can attend. This not only motivates you but also helps you understand how to calculate the debts manually, which formulas are applied and so much more.

Crown snowball debt calculator has a team that is working in several positions. If you consider yourself a potential candidate and are confident that you are a perfect fit for this job, then you can even apply at crown snowball debt calculator.

Crown snowball debt calculator has an online store from where you can invest to save up your money or you can apply to become a manager at their online store.

The manager has some responsibilities and he/she must have knowledge about the debts and how they are paid off.

You can either become a member of crown debt snowball calculator or follow it on social media; Facebook, Twitter and Instagram to get all the latest updates and news.

End Note

Although snowball debt calculators are newly introduced tools, you will be amazed to see the number of online snowball debt calculators with a variety of interfaces.

You have to choose the best one for your use and pay off your debts as fast as possible.